Credit Union Cheyenne: Exceptional Member Providers and Financial Products

Credit Union Cheyenne: Exceptional Member Providers and Financial Products

Blog Article

Opening the Conveniences of Cooperative Credit Union: Your Overview

In the world of banks, lending institution stand as a frequently underexplored and unique alternative for those looking for a more tailored technique to banking. As we look into the complexities of lending institution, a globe of advantages and opportunities unravels, offering a look into an economic landscape where area values and member-focused solutions take facility phase. From their simple starts to their contemporary impact, recognizing the significance of credit unions might potentially improve the way you see and handle your finances.

Background of Cooperative Credit Union

The principle of credit score unions emerged as a feedback to the financial demands of individuals that were underserved by typical financial institutions. Friedrich Wilhelm Raiffeisen, a German mayor, is commonly credited with starting the first contemporary credit union in the mid-1800s.

The idea of individuals integrating to merge their sources and give financial aid to every other spread rapidly across Europe and later on to The United States and Canada. In 1909, the initial lending institution in the USA was established in New Hampshire, marking the beginning of a brand-new era in community-focused financial. Ever since, cooperative credit union have actually continued to prioritize the economic health of their members over profit, symbolizing the cooperative principles of self-help, self-responsibility, democracy, equal rights, equity, and uniformity.

Membership Eligibility Criteria

Having actually established a structure rooted in participating principles and community-focused financial, credit scores unions keep certain membership qualification criteria to make sure placement with their core worths and purposes. These criteria usually focus on an usual bond shared by prospective members, which could include aspects such as geographical place, employer, business affiliation, or subscription in a specific area or organization. By requiring members to satisfy particular qualification demands, credit score unions aim to foster a feeling of belonging and shared function among their participants, reinforcing the participating nature of these banks.

Along with usual bonds, some cooperative credit union may likewise prolong membership qualification to household members of current participants or people that reside in the very same household. This inclusivity aids lending institution increase their reach while still remaining real to their community-oriented principles. By maintaining clear and transparent subscription standards, credit rating unions can ensure that their members are actively involved in sustaining the cooperative values and goals of the establishment.

Financial Products and Providers

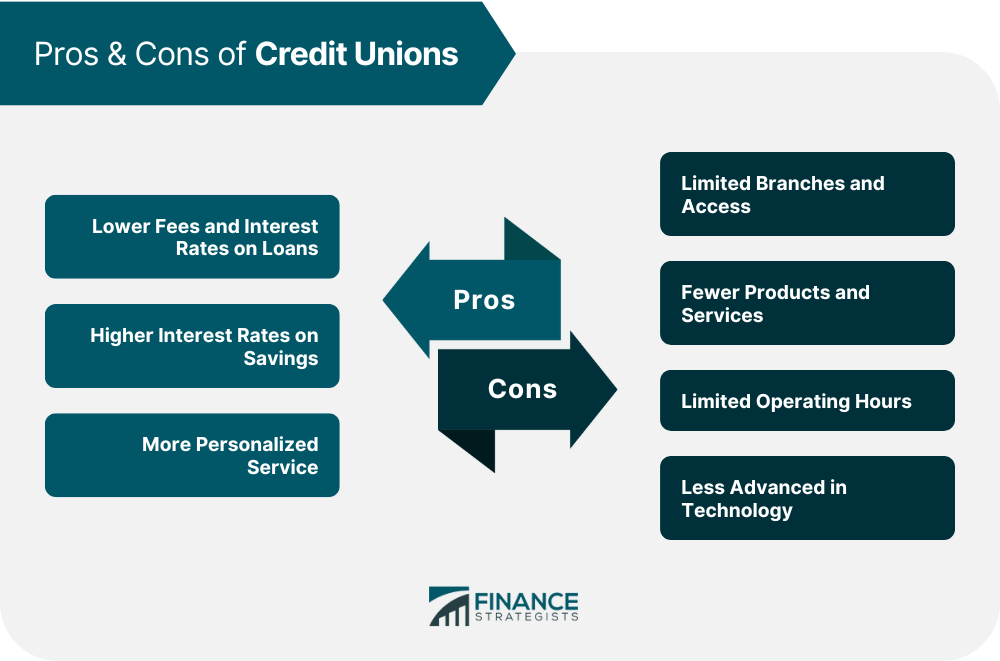

When thinking about the array of offerings available, debt unions offer a diverse array of financial products and services customized to satisfy the special demands of their participants. Participants usually benefit from personalized client solution, as credit unions focus on developing solid partnerships with those they serve.

In addition, cooperative credit union regularly use economic education and learning and counseling to help members boost their financial literacy and make educated choices. Lots of lending institution likewise participate in shared branching networks, allowing participants to access their accounts at a range of locations across the country. In general, the variety of economic products and solutions offered by credit scores unions underscores their commitment to fulfilling the diverse requirements of their members while prioritizing their economic health.

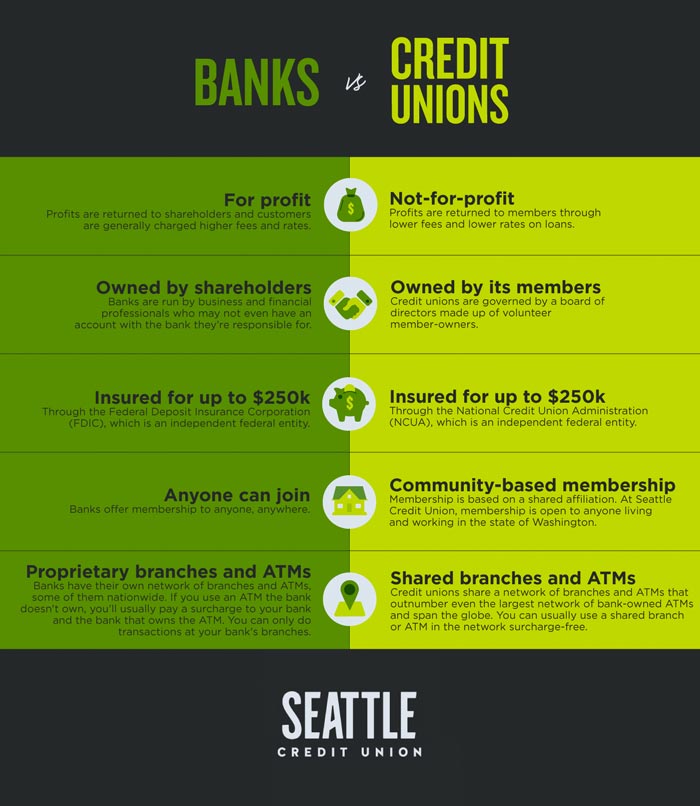

Advantages Over Standard Banks

Showing a distinctive strategy to economic solutions, cooperative credit union provide a number of benefits over standard financial institutions. One vital advantage is that lending institution are usually member-owned, suggesting that profits are reinvested into the organization to provide far better prices and lower costs for participants. This cooperative framework commonly results in more individualized customer support, as cooperative credit union prioritize participant satisfaction over taking full advantage of profits. In addition, lending institution are known for their competitive rates of interest on savings accounts, car loans, and charge card. This can result in greater returns for participants that save or borrow cash with the cooperative credit union compared to standard financial institutions.

Moreover, lending institution tend to have a solid concentrate on economic education and learning and community support. They frequently provide sources and workshops to aid participants boost their monetary literacy and make sound money management choices (Credit Union Cheyenne). By promoting a sense of area and shared goals, cooperative click for more info credit union can create a much more comprehensive and supportive financial atmosphere for their members

Area Participation and Social Effect

By collaborating with these entities, credit scores unions can amplify their social influence and address crucial issues impacting their neighborhoods. In significance, debt unions offer as drivers for positive adjustment, driving community development and social development through their energetic participation and impactful campaigns.

Conclusion

Finally, cooperative credit union have an abundant history rooted in area and participation, offering a varied range of economic items and services with get more competitive prices and personalized customer solution. They prioritize the financial wellness of their participants over revenue, fostering a sense of belonging and providing economic education and learning. By proactively taking part in social effect efforts, credit score unions produce a her comment is here helpful and inclusive banking environment that makes a positive difference in both specific lives and areas.

Friedrich Wilhelm Raiffeisen, a German mayor, is usually credited with starting the initial modern debt union in the mid-1800s - Wyoming Credit Unions. By needing participants to meet particular eligibility demands, credit scores unions intend to cultivate a sense of belonging and shared function amongst their members, strengthening the participating nature of these economic organizations

Additionally, debt unions frequently supply monetary education and learning and therapy to assist members enhance their monetary literacy and make educated choices. On the whole, the array of monetary products and services provided by credit score unions highlights their commitment to meeting the diverse needs of their participants while prioritizing their monetary wellness.

Furthermore, credit unions are understood for their affordable passion rates on savings accounts, loans, and credit history cards.

Report this page